DOP Prices, Trends & Forecasts The Procurement

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

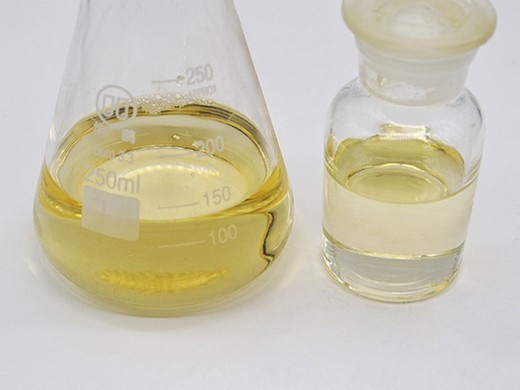

- cas no 117-84-0

- Other Names:DOP Bis(2-ethylhexyl) phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5, ≥99.5

- Type:Plastizer

- Usage:Leather Auxiliary Agents, Paper Chemicals, Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents, Leather Auxiliary Agent,Plastic Auxiliary Agent,

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

Key Details About the DOP Price Trend: Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the DOP price in its latest pricing

This situation has contributed to fluctuating and increased prices for DOP. Read More About Dioctyl Phthalate Production Cost Reports Request Free Sample Copy in PDF.

Dioctyl terephthalate Prices, Trends & Forecasts

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP, diocty phthalate, 1,2-phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%, 99.5%

- Type:Liquid, plasticizer

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Place of Origin::China

- Advantage:Stable

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on Dioctyl terephthalate in its latest pricing dashboard. industrial uses, and

The Dioctyl Phthalate (DOP) Price chart, including India Dioctyl Phthalate (DOP) price, USA Dioctyl Phthalate (DOP) price, pricing database, and analysis can prove valuable

DOP Prices, Trend & Forecasts Provided by Procurement

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Chemical Auxiliary Agent

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%, 99.9%min.

- Type:Liquid, plasticizer

- Usage:Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Payment:T/T

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the DOP price in its latest pricing

Price Trends ; Industries Procurement Resource +900 Reports with Up-to-Date and Independent Economic Analyses. Offer services to more than 15 industrial domains with a team of

DOP Price Trend Provided by Procurement Resource

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP/Dioctyl Phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5, ≥99.5

- Type:Plasticizer

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

The DOP Price chart, including India’s DOP price, USA’s DOP price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision

During Q1 2024, the Dioctyl Phthalate (DOP) market in the APAC region experienced mixed trends, with significant factors influencing market prices. Generally, DOP prices were

DOP Prices Archives The Procurement Expert

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%, 99% min

- Type:Liquid, plasticizer

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Paper Chemicals

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Volume Resistivity:317

- Item:T/T,L/C

Extensive Inulin Production Cost: Cost Model, Pre-feasibility, Industrial Trends, Labor

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the Methyl Chloride price in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial

- What is the price trend of DOP (dioctyl phthalate)?

- The price trend for DOP (Dioctyl Phthalate) is estimated to improve on the back of growing momentum of the downstream automotive industries and improving global economic parameters. According to Procurement Resource, DOP (Dioctyl Phthalate) Price Trend for the October - December of 2023.

- What factors impacted the DOP market in South Korea?

- One significant factor was the overall weak demand from key industries such as construction and automotive, which led to reduced consumption and downward pressure on prices. Additionally, the presence of competitive pricing strategies from China further impacted the market, making it challenging for South Korean DOP manufacturers.

- How did DOP market perform during a weak economic era?

- During the weak economic era, DOP traders managed inventories to meet the product requirements throughout the quarter. According to US Price Index for the PVC sector, improvements from 338.1 (March) to 344.7 (April) were observed amid a shortage of homes for sale, which remained unaffected by DOP prices.

- How did the restocking of crude oil affect the DOP market?

- The hesitation to restock inventories further slowed market circulation, deepening the cautious sentiment in the DOP market. Additionally, the recent depreciation in upstream crude oil prices provided further relief to DOP prices. Terminal demand remained weak, with traders unsure of market direction.

- How is the DOP market influenced by the PVC sector?

- The DOP market is highly influenced by the downstream PVC sector, which is used as a key housing factor in the construction industry. The construction sector was growing in Europe amidst an increase in sales for in-built houses. Due to the rising prices for rental houses, consumers' enthusiasm towards the houses is hampering sales.

- How did DOP prices change in South Korea?

- Generally, DOP prices were influenced by limited regional supplies, moderate to high demand from the downstream industry, and fluctuations in raw material costs. In South Korea, the market witnessed the most significant price changes, with a price increase of 3.8% in December 2023 and remaining stable in January 2024.