MEMORANDUM NO M-2023- Bangko Sentral ng

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

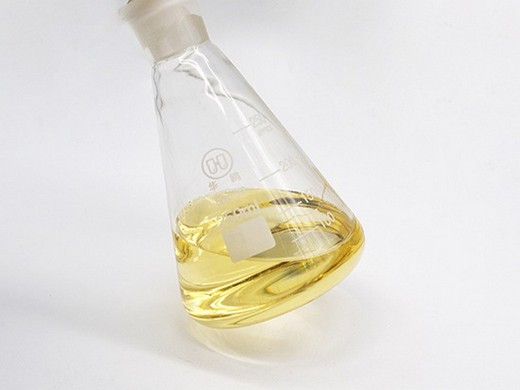

- cas no 117-84-0

- Other Names:Dioctyl Phthalate DOP

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.99, 99%

- Type:Adsorbent, plasticizer

- Usage:Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Application:PVC Plasticizer

diligence (CDD), including risk and trigger-based updating, and adoption of suitable TM infrastructure with machine learning capabilities, as warranted, that supports holistic review

Philippines 18th February 2021 The new framework will use a four-point rating scale to grade FIs based on their inherent risks, risk management capabilities and self-assessment systems. The

CIRCULAR LETTER NO. CL-2023- Bangko Sentral ng

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP/Dioctyl Phthalate

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5% Min

- Type:Adsorbent

- Usage:Plastic Auxiliary Agents, Plasticizer

- MOQ::10 Tons

- Package:25kg/drum

- Advantage:Stable

- Keywords:Plasticizer Dop

To : All BSP-Supervised Financial Institutions (BSFIs) Subject : Anti-Money Laundering Council (AMLC) 2022 Terrorism and Terrorism Financing (TF) Risk Assessment This is to disseminate

The role of supervision in an AML/CTF framework is to supervise and monitor covered persons to ensure that their ML/TF risks are managed, and AML/CFT preventive measures are compliant

BSP tightens guard vs dirty money, terrorist financing

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dop

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.99, 99%

- Type:Carbon Black

- Usage:Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Application:PVC Plasticizer

The Bangko Sentral ng Pilipinas has adopted a new money laundering and terrorist risk assessment framework for banks and other supervised financial institutions as

The findings from institutional risk assessments should be used to enhance AML/CFT/CPF/sanctions compliance programmes and made available to the BSP during

AML/CFT The EU Comprehensive Package: essential

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Chemical Auxiliary Agent

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99%

- Type:Plasticizer

- Usage:Leather Auxiliary Agents, Paper Chemicals, Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents, Leather Auxiliary Agent,Plastic Auxiliary Agent,

- MOQ::10 Tons

- Package:25kg/drum

- Keywords:Plasticizer Dop

On 19 June 2024, the European Parliament and Council published the new anti-money laundering and countering the financing of terrorism (“ AML/CFT ”) package an extensive reformative

FinCEN’s proposed new AML/CFT program rule is intended to redirect AML/CFT programs to focus on the highest-risk areas, using innovative techniques and a goal-oriented

Fact Sheet: Proposed Rule to Strengthen and Modernize

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP/Dioctyl Phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%, 99% min

- Type:Adsorbent

- Usage:Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Application:PVC Plasticizer

The proposed amendments are based on changes enacted by the Anti-Money Laundering (AML) Act of 2020 (AML Act) and are a key component of Treasury’s objective of a more effective

FinCEN expects the risk assessment process will serve as the foundation for the design and implementation of other program components, including internal controls that are

- What is the role of supervision in an AML/CTF framework?

- to which they are exposed.1The role of supervision in an AML/CTF framework is to supervise and monitor covered persons to ensure that their ML/TF risks are managed, and AML/CFT preventive measures are complia t with laws and regulations. Different jurisdictions adopt different measures to ensure complianc

- What is the new anti-money laundering and countering terrorism (AML/CFT) package?

- On 19 June 2024, the European Parliament and Council published the new anti-money laundering and countering the financing of terrorism (“AML/CFT”) package – an extensive reformative legislative package – that consists of three main legal texts:

- Should AML/CFT programs be risk-based?

- Finally, the BSA notes that AML/CFT programs should be risk-based, including ensuring that more atention and resources of financial institutions should be directed toward higher-risk customers and activities, consistent with the risk profile of a financial institution, rather than toward lower-risk customers and activities.

- What should you know about the proposed AML/CFT rule?

- Here are six things to know about the Proposed Rule: 1. AML/CFT programs must be “effective” and “risk based.” Current FinCEN regulations implementing the Bank Secrecy Act (“BSA”) generally require that AML/CFT programs and controls be “reasonably designed” to either achieve compliance with the BSA, prevent money laundering, or both.

- Does the Philippines have anti-terrorism and TF risk assessments?

- Since 2016, the Philippines has published and participated in several anti-terrorism and TF risk assessments. The First and Second National Money Laundering and Terrorism Financing (ML/TF) Risk Assessment reports, which were published in 2016 and 2017, respectively, both rated terrorism and TF as high risk.

- Do bsfis consider money laundering and Terrorist Financing risks?

- vernment Agencies (AGAs).2 Accordingly, all BSFIs are expected to consider the money laundering, terrorist financing, and proliferation financing risks arising from the transactions of DNF in their risk assessment. idance.CHUCHI