29173920 Other: Dioctyl phthalate India Import Duty

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dioctyl Phthalate DOP

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%min, 99.5%min

- Type:Chemical additives, Chemical dop plasticizer 99%

- Usage:PVC Products, Coating Auxiliary Agents, Leather Auxiliary Agents,

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Place of Origin::China

- Item:T/T,L/C

Notification No. 70/2024–Customs (N.T) "Notification under Section 28A of Customs Act, 1962 for Non-Levy of Customs Duty on the import of Simply Sawn Diamonds

Instruction No. 07/2017-Customs. F. No. 528/07/2017-STO (TU) Government of India. Ministry of finance. Department of Revenue. Central Board of Excise & Customs (Tariff

Custom Duty Calculator icegate

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99 %

- Type:Liquid, plasticizer

- Usage:PVC Products, Coating Auxiliary Agents, Leather Auxiliary Agents,

- MOQ:200kgs

- Package:200kgs/battle

- Model:Dop Oil For Pvc

It provides service to the trade to calculate applicable custom duty on goods imported or exported by them.

India Custom Duty, Import Duty and Import Tariffs from Chapter 1 to 98 after GST . Check Custom Duty in India, Import Duty and Import Tariffs by Product Name or HS Code from

Dioctyl Phthalate Import Data of HS Code 29173990 India

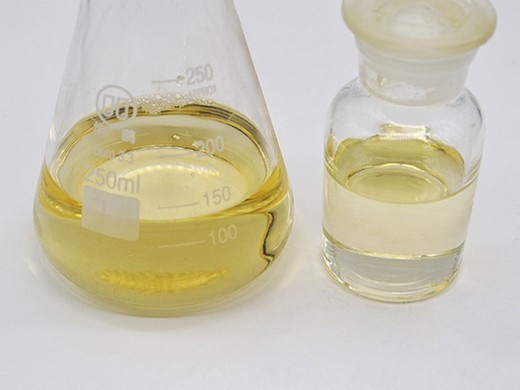

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DiOctyle Phthalate DOP

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99%min

- Type:Plastizer

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Application:PVC Plasticizer

Get detailed and the latest Dioctyl Phthalate import data of HS code 29173990 India with customs shipment details as price, date, Indian import port, importers and buyers in India. Dioctyl

V. Steps to Calculate Customs Duty in India. Calculating customs duty on imported goods in India involves several steps. Below is a step-by-step guide to help you calculate

Customs Import Duty of phthalate dop in India Zauba

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dioctyl Phthalate

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.6%, 99.6%

- Type:Carbon Black

- Usage:Coating Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Shape:Powder

- Model:Dop Oil For Pvc

29173920 : Other: Dioctyl phthalate; Description Duty; Basic Duty 7.50: Education Cess 2.00: Secondary Hiigher Education Cess 1.00: Contravailing Duty (CVD) 12.00: Additional

Import duty in India on chapter 29 Organic Chemicals after GST. Calculate India custom duty by HS code or Product with the help of our custom duty calculator after GST. Search Indian

29173920 Other: Dioctyl phthalate India Import Duty,

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP, diocty phthalate, 1,2-phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:≥99.5%

- Type:pvc additive

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Paper Chemicals

- MOQ::10 Tons

- Package:25kg/drum

- Place of Origin::China

- Item:T/T,L/C

29173920 Other: Dioctyl phthalate Updated India Import Duty and Custom duty of Customs tariff of 2006, 2007, 2008 and 2009 in Single View.

29173910 Other: Dibutyl phthalate Updated India Import Duty and Custom duty of Customs tariff of 2006, 2007, 2008 and 2009 in Single View.

- Why is customs tax important in India?

- This tax is an important source of revenue for the Indian government and is used to regulate the flow of goods across borders. The customs duty calculation process in India is governed by the Customs Act, 1962, which lays down the legal provisions related to the import and export of goods.

- What is customs duty in India?

- Understanding Customs Duty in India Customs duty is a tax that is imposed on goods that are imported into India from foreign countries. This tax is an important source of revenue for the Indian government and is used to regulate the flow of goods across borders.

- What is basic customs duty (BCD)?

- Basic Customs Duty (BCD): Basic Customs Duty is the most common type of customs duty in India. It is a duty that is levied as a percentage of the assessable value of the imported goods. The assessable value of the goods is calculated by adding the cost of the goods, insurance charges, and freight charges incurred in transporting the goods to India.

- What is additional customs duty (ACD)?

- Additional Customs Duty (ACD): Additional Customs Duty is a type of customs duty that is levied on certain goods that are imported into India. It is also known as Countervailing Duty (CVD) and is charged at the same rate as the excise duty that is applicable to similar goods produced in India.

- What is anti-dumping duty & customs duty?

- The Anti-Dumping Duty is levied as a percentage of the value of the imported goods and is usually imposed on goods that are being imported in large quantities and are causing injury to the domestic industry. Customs duty is an important source of revenue for the Indian government and is used to regulate the flow of goods across borders.

- How is customs duty calculated?

- It is calculated at a rate of 2% of the total customs duty payable. Additionally, some goods may attract other charges such as Anti-dumping Duty (ADD), Safeguard Duty (SGD), or Special Additional Duty (SAD).