Priority Thrusts Message from the President

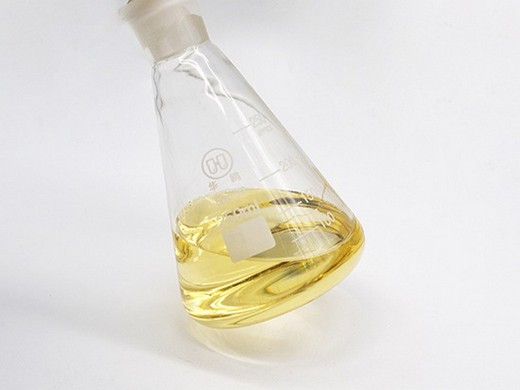

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:DBP

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:99.6%

- Type:Adsorbent

- Usage: Rubber Auxiliary Agents,

- MOQ:25kg/bag

- Package:200kg/drum

- Application:Plasticizer

Finally, I urge the DBP to ramp up efforts in digitalization, sustainability, and rural development. lt must continue to develop data-driven and creative financial and technical assistance programs

The Development Bank of the Philippines (DBP) has surpassed all its financial targets in 2019, with total assets growing 14 percent to P762.27 billion and gross income rising

PRESS RELEASE 25 November 2024 GCG CELEBRATES

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl Phthalate (DBP)

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:98%

- Type:Plastics Additives

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:25kg/bag

- Package:200kg/drum

- Application:Plasticizer

criteria, targets, and weights reported in a Performance Scorecard. Based on the 2023 In an inspirational speech, Department of Finance (DOF) Undersecretary Maria Luwalhati C.

STATE-OWNED Development Bank of the Philippines (DBP) is working closely with the Department of Finance (DoF), state regulators and legislators in introducing reforms in

Landbank-DBP merger to be completed first half of 2024

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Elasticizer

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:98%

- Type:plasticizer

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents,

- MOQ:25kg/bag

- Package:200kg/drum

- Sample:Availabe

- Application:Plasticizer

- Quality control:COA ,SDS,TDS

- Delivery:Within 7-15 Days

MANILA The completion of the planned merger between the Land Bank of the Philippines (Landbank) and the Development Bank of the Philippines (DBP) is expected to be

State-owned Development Bank of the Philippines (DBP) is working closely with the Department of Finance (DOF), state regulators and legislators in introducing reforms in its 26

Department of Finance Canada 2024–25 Departmental plan

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl phthalate DBP

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:99.6%

- Type:PVC additives

- Usage:PVC shoe, PVC Air Blowing/Expander PVC/DIP Shoes

- MOQ:25kg/bag

- Package:200kg/drum

- Application:Plasticizer

Explanation of table 2. 10 Indicator added in 2021 with results met given net debt was low relative to G7 comparators.. 11 The pandemic-induced economic downturn and

State-owned Development Bank of the Philippines’ (DBP) net income for the first six months of 2023 rose 60 percent to hit P4.42-billion, compared to the P2.76-billion that the

DBP eyes over P30 billion from bond sale in Q4 Philstar

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl Phthalate (DBP)

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:99.5%Min

- Type:Plastics Additives

- Usage:Surfactants,

- MOQ:25kg/bag

- Package:200kg/drum

- Delivery:Within 7-15 Days

DBP’s charter was last amended in 1998, which raised the bank’s authorized capital stock to P35 billion from P5 billion. DBP is the eighth largest bank in the country in

Finance Secretary Ralph Recto earlier said the DOF is looking to amend the DBP charter, as well as that of the Land Bank of the Philippines, to broaden the local capital market.

- What changes are being made to the DBP's charter?

- The Department of Finance (DOF) has already submitted proposed changes in the DBP’s charter, as well as that of the Land Bank of the Philippines. Among key amendments to the DBP’s charter is the increase in its authorized capital stock to P300 billion, an over 700-percent increase from the current level of P35 billion.

- Will DBP return to debt market?

- DBP president and CEO Michael de Jesus said the bank would return to the debt market toward the end of the year as part of its fundraising activities. MANILA, Philippines — State-run Development Bank of the Philippines plans to raise over P30 billion from a bond issuance in the fourth quarter of the year.

- How much money will DBP raise from a bond issuance?

- MANILA, Philippines — State-run Development Bank of the Philippines plans to raise over P30 billion from a bond issuance in the fourth quarter of the year. DBP president and CEO Michael de Jesus said the bank would return to the debt market toward the end of the year as part of its fundraising activities.

- How did the Development Bank of the Philippines perform in 2019?

- The Development Bank of the Philippines (DBP) has surpassed all its financial targets in 2019, with total assets growing 14 percent to P762.27 billion and gross income rising 26 percent to P32.87 billion, a report to Finance Secretary Carlos Dominguez III has shown.

- Will DBP be listed on the Philippine Stock Exchange?

- Amending DBP’s charter would also allow the bank to be listed on the Philippine Stock Exchange as early as next year. DBP’s charter was last amended in 1998, which raised the bank’s authorized capital stock to P35 billion from P5 billion. DBP is the eighth largest bank in the country in terms of assets.

- How did DBP's capital grow last year?

- DBP president-CEO Emmanuel Herbosa said in his report that last year, the Bank’s capital expanded 16.57 percent to P60.29 billion, which was at a faster pace than the average growth rate of 11.04 percent over the 2016-2018 period.