Holding It All in Tension: The Risks and Opportunities of

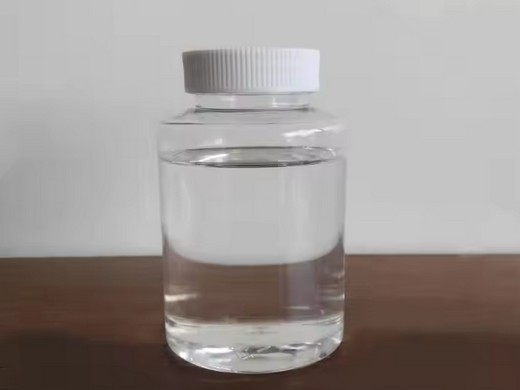

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Liquid DOP, DOP oil

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:≥99.5%

- Type:Plastic Auxiliary Agents

- Usage:Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Model:Dop Oil For Pvc

- Storage:Dry Place

Nigeria has the largest economy in Africa, with deep potential for growth in the energy, technology, and financial services sectors. However, entrenched public corruption and

by Ambrose Nnaji ‘Digital payment will boost businesses’ According to Lawal, the TechConnect series traversed Nigeria’s key financial

Scaling Up Business Financing and Nigeria’s Industrial

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dop

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.99, 99%

- Type:DOP

- Usage:Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Volume Resistivity:581

The players in the financial system have embraced and are leveraging technology in improving access, increasing funding and supporting businesses in Nigeria Growing Business Financing

9 hours agoBusiness . December 2, Leadership Award, a highlight of the IFIC, celebrates organizations and individuals advancing the goals outlined in Nigeria’s National Financial

Exploring the Nigerian business landscape: opportunities

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP, diocty phthalate, 1,2-phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99

- Type:non-toxic calcium zinc stabilizer

- Usage:Chemical Auxiliary Agent, Leather Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Model:Dop Oil For Pvc

- Storage:Dry Place

However, with Nigeria’s existing and rising business opportunities, all is not gloom. For instance, with a population estimated at over 200 million people with projections to grow to

ease of doing business across Nigeria. The study was carried out in collaboration with the Enabling Business Environment Secretariat (EBES) of Nigeria’s Presidential Enabling

Latest Nigeria Business News Headlines Guardian Nigeria

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP, Dioctyl phthalate

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.6%, 99.6%

- Type:Liquid, plasticizer

- Usage:Coating Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Payment:T/T

- Certificate::COA

Read the recent business news in Nigeria and across the globe from Guardian Newspaper including analysis on financial market and economic news.

The latest edition of the Doing Business in Nigeria Snapshot guide is now available to download. This publication provides information on an array of investment incentives available in Nigeria,

How to DOP? What is a Digital Operations

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dop

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.0%Min

- Type:Plastizer

- Usage:Coating Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Advantage:Stable

- Payment:T/T

With a DOP, businesses can simplify their operations, reduce errors, and free up time for employees to focus on higher-value tasks, such as customer service and business growth initiatives. Ultimately, a DOP offers

Convert DOP to NGN with the Wise Currency Converter. Analyze historical currency charts or live Dominican peso / Nigerian naira rates and get free rate alerts directly to your email. The information shown there does not constitute financial advice. Conversion rates Dominican Peso / Nigerian Naira; 1 DOP: 28,43270 NGN: 5 DOP: 142,16350 NGN:

- How did business improve in Nigeria?

- Nigeria improved significantly in “starting a business, dealing with construction permits, getting electricity, registering property, trading across borders and enforcing contracts” indices. Download our guide to doing business in Nigeria, which covers: This article forms part of Doing Business in Africa:

- What are the key aspects of Business Finance in Nigeria?

- Business finance is essential for the success and growth of businesses in Nigeria. Access to capital, cash flow management, and financial planning are vital to ensure sustainable operations and to seize growth opportunities. This blog post aims to shed light on the key aspects of business finance in Nigeria.

- How to manage a business in Nigeria?

- Budgeting and Financial planning are crucial aspects of managing a business in Nigeria. Businesses must create a budget to allocate resources and plan for future expenses. Financial planning involves setting financial goals and creating a roadmap to achieve them.

- What financing options are available for businesses in Nigeria?

- In the Nigerian business landscape, businesses can tap into diverse financing avenues: debt, equity, government aid, and alternative sources. Debt financing, a favorite choice, involves securing funds from banks for expansion or operations. Bonds and debentures are additional debt options.

- Is Nigeria a good place to start a business?

- In the 2020 Ease of Doing Business index developed by the World Bank, Nigeria’s rank jumps from 146 to 131, globally, moving up 15 places and 21st in the Sub-Saharan Africa. The global ranking represents its second-highest annual progress of 11.45% in a decade. The highest annual growth remains at 14.2%.

- What is financial analysis in Nigeria?

- Financial analysis involves assessing the financial health and performance of a Nigerian business. It includes analyzing financial statements, ratios, trends, and other key indicators. Businesses use financial analysis to evaluate their strengths, weaknesses, opportunities, and threats.