France transfer pricing Grant Thornton insights

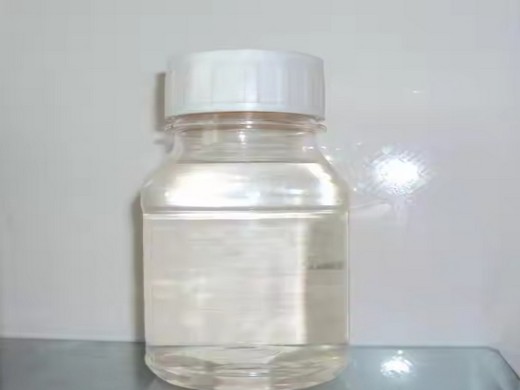

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DiOctyle Phthalate DOP

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5, ≥99.5

- Type:Chemical additives, Chemical dop plasticizer 99%

- Usage:PVC shoe, PVC Air Blowing/Expander PVC/DIP Shoes

- MOQ::10 Tons

- Package:25kg/drum

- Model:Dop Oil For Pvc

An overview of transfer pricing rules in France and who to contact for expert guidance. 2024 marks the 20th year of Women in business where we monitor and measure

The Finance Act 2024 now renders transfer pricing documentation enforceable and establishes a presumption of an indirect transfer of profits where the method used by the company to

France: New transfer pricing measures KPMG United States

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP Bis(2-ethylhexyl) phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%min

- Type:non-toxic calcium zinc stabilizer

- Usage:Chemical Auxiliary Agent, Leather Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Storage:Dry Place

The government announced new transfer pricing measures to be included in the 2024 Draft Finance Bill (Projet de Loi de Finances or PLF) aimed at strengthening the tax

Form. In France, a sale of goods contract is legally binding whether entered into orally or in writing. performance of a sale and purchase agreement results in immediate transfer of

France PwC

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP Bis(2-ethylhexyl) phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%, 99% min

- Type:Plastic Auxiliary, Dop Plasticizer For Pvc

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Storage:Dry Place

France enterprises indirectly via increases or decreases in purchase or selling prices, or by any other means, shall be added back into the taxable income shown in the companies’ accounts.

The European Commission (“Commission”) finally published the definitive version of the new Vertical Block Exemption Regulation 2022/270 (“VBER”) and accompanying

Drugs manufactured in France to match highest price on EU

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Liquid DOP, DOP oil

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.99, 99%

- Type:Adsorbent, plasticizer

- Usage:Plastic Auxiliary Agents, Plasticizer

- MOQ:200kgs

- Package:200kgs/battle

- Keywords:Plasticizer Dop

This new price regulating agreement places a major shift in ex-factory and list pricing, affecting the competitiveness of indications in the French market as well as the overall

Consumer law in France is currently being adapted to the digital sector and to offer better protection to consumers. As part of the European Commission’s New Deal for

factory price DOP Retailer Agreement Form 2023 France

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:Dioctyl Phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%, 99.5%

- Type:Adsorbent, Carbon Black

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Surfactants, Textile Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Storage:Dry Place

Retail price is calculated with the following formula: Wholesale Price / (1 Markup Percentage) = Retail Price Here’s an example based on a wholesale price of $30 and a 60% markup

Make, sign & save a customized Retailer Agreement with Rocket Lawyer. Account. Explore. The Seller may amend prices upon notice to Retailer, provided any such amendment shall reflect similar prices applicable to the

- Will transfer pricing be included in the 2024 PLF?

- The government's roadmap in the fight against “all forms of fraud” includes several measures relating to transfer pricing to be included in the 2024 PLF. The measures are designed to build both accountability and confidence among taxpayers.

- How does the Finance Act 2024 affect transfer pricing?

- The Finance Act 2024 now renders transfer pricing documentation enforceable and establishes a presumption of an indirect transfer of profits where the method used by the company to determine transfer prices differs from the method set out in the documentation. The taxpayer can challenge this presumption by any means.

- Who is required to document transfer pricing in France?

- The obligation in France to document transfer pricing applies to all French taxpayers (including permanent establishments of foreign companies) which: Is a member of a tax consolidation group, where this group includes at least one legal entity meeting one of the above conditions (e. condition a, b or c).

- What are the new transfer pricing documentation requirements?

- The new general transfer pricing documentation requirements apply to tax years beginning on or after 1 January 2010 and to any one of the following types of entities located in France: With turnover or gross assets on the balance sheet exceeding 400 million euro (EUR).

- How do I declare transfer prices in France?

- B – ANNUAL DECLARATION Article 223 quinquies B of the French General Tax Code (FGTC) provides for the obligation to declare transfer prices. This declaration (Cerfa form 2257-SD) must be filed electronically each year by certain French taxpayers and within six months of the filing of their tax return.

- When will the 2024 PLF be released?

- The 2024 PLF will have to take this into account if it wants to avoid creating unfair conditions that do not reflect the situation that would prevail between independent companies. The 2024 PLF is expected to be released at the end of September. For more information, contact a KPMG tax professional in France: