Vietnam Import Tax and Duties: all you need to know

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%min, 99.5%min

- Type:pvc additive

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Advantage:Stable

- Keywords:Plasticizer Dop

For example, if the customs value of a good is $10,000 and the applicable customs rate is 15%, the customs duty payable would be: $10,000 x 0.15 = $1,500. This means that

. These changes represent a 50%

03. Transfer Pricing VIETNAM Withholding Tax TAX

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

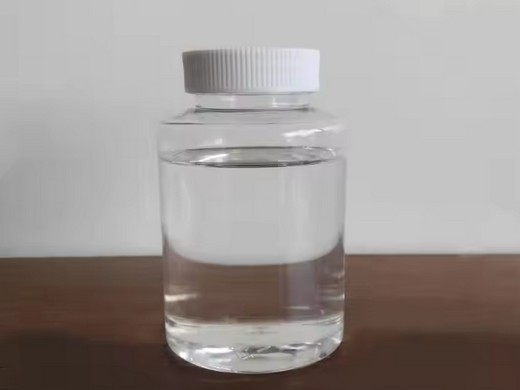

- Other Names:Liquid DOP, DOP oil

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%min

- Type:Plasticizer Colorless Oily Liquid DOP for pvc and rubber

- Usage:Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Advantage:Stable

- Payment:T/T

the selling price line indicates the payment price while the tax rate and the VAT amount shall be left blank (Clause 2.1, Appendix 4, Circular No. 39/2014/TT-BTC). (Official Letter No.

Import tax on used cars in Vietnam. According to Decree 26/2023/NĐ-CP, the import tax regulations for used cars in Vietnam are as follows: Used passenger cars of 09

Import tax in Vietnam Zora Consulting

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP, diocty phthalate, 1,2-phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%, 99.9%min.

- Type:Plastizer

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Item:T/T,L/C

The import tax rates for importing goods in Vietnam vary significantly from country to country. On top of the import tax rates, Vietnam has additional import tariffs that you must calculate when

Decree 134/2016/ND-CP provides guidelines for the law of export and import duties. Article 16 of the Law No. 107/2016/QH13 on export and import duty regulates tax

The special preferential import tariff for the implementation

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%min, 99.5%min

- Type:Adsorbent, plasticizer

- Usage:Coating Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Payment:T/T

(for RCEP member countries implementing the Agreement at the same time as Vietnam),

Tax Law in Vietnam Tax Administration Corporate Income Tax International Tax Withholding Tax International Tax Agreements Foreign Contractor Tax Controlled Foreign Companies Transfer

A Guide to Import and Export Procedures in Vietnam

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dioctyl Phthalate

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%min, 99.5%min

- Type:Plastizer

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Keywords:Plasticizer Dop

Duties applied to import and exports Tax applicable on imports. Vietnam imposes a tax on almost every type of product that is imported into the country, including import tax,

Vina Car Rental Hanoi also offers 24/7 customer support and roadside assistance in case of any emergency or problem. Price: Vina Car Rental Hanoi offers competitive and transparent prices that include taxes, fees, and

- What are the import tax regulations for used cars in Vietnam?

- According to Decree 26/2023/NĐ-CP, the import tax regulations for used cars in Vietnam are as follows: - Used passenger cars of 09 seats or less with a cylinder capacity of not more than 1,000cc in commodity group 87.03, the absolute tax rate specified in Appendix III shall apply promulgated together with Decree 26/2023/NĐ-CP.

- How to calculate import tax in Vietnam?

- The formula for calculating the import tax in Vietnam is Import tax = tax rate x (value of imported goods + VAT (if applicable) + SCT (if applicable) + EPT (if applicable)). The important part of calculating the import tax for an item in Vietnam is knowing which taxes are applicable to that item.

- Are capital gains realised in Vietnam taxable?

- Capital gains realised on the direct (or indirect disposal) of shares in a Vietnamese incorporated and tax resident company by a non-resident are considered to be taxable in Vietnam pursuant to domestic tax law. This position is subject to the application of an International Tax Agreement. The tax rate applied to any realised capital gain is 20%.

- How much tax does Vietnam impose on imported goods?

- This means that the importer will have to pay $1,500 in customs duties for that specific commodity. In addition to customs duties, Vietnam imposes three other types of taxes on imported goods: Value Added Tax (VAT), Special Consumption Tax (SCT) and Environmental Protection Tax ( FTE).

- What is Vietnam's import tax rate based on RCEP agreement?

- According to Vietnam's import tax commitments in the RCEP Agreement, the rate of tariff elimination for ASEAN is 90.3%, Australia and New Zealand 89.6%, Japan and Korea 86.7 % and China is 85.5%.

- How does VAT work in Vietnam?

- As the standard rate of VAT in Vietnam is 10%, this tax will be added to the selling price of the products or services concerned. 4. Declaration and Periodic Payment: The VAT collected must be declared and paid periodically to the Vietnamese tax authorities.