DBP, partners champion Green Financing Eco-Business

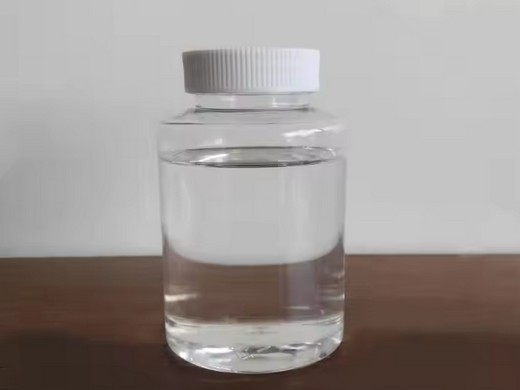

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:DBP

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:98%

- Type:Adsorbent

- Usage:Coating Auxiliary Agents, Surfactants,

- MOQ:25kg/bag

- Package:200kg/drum

- Sample:Availabe

- Application:Plasticizer

- Quality control:COA ,SDS,TDS

- Delivery:Within 7-15 Days

The Development Bank of the Philippines (DBP) has partnered with four institutions to promote Green Financing investing in processes and systems friendly to the

To help local government units and regulated industries, the Department of Environment and Natural Resources (DENR) through the Environmental Management Bureau

Green Financing for Sustainable Construction: A Guide to

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:DBP

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:≥99.5

- Type:Adsorbent

- Usage:Polyurethane (pu),

- MOQ:25kg/bag

- Package:200kg/drum

- Delivery:Within 7-15 Days

Image from Power Philippines The Development Bank of the Philippines (DBP) has emerged as a key player in promoting sustainable development through its innovative

Local banks like the Bank of the Philippine Islands (BPI), the Development Bank of the Philippines (DBP), and LANDBANK are a few financial institutions that offer loans for green projects. To learn more about the loans

Greening through finance: Green finance policies and firms'

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl phthalate DBP

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:99%, 99%

- Type:PVC additives

- Usage:Coating Auxiliary Agents, Plastic Auxiliary Agents,

- MOQ:25kg/bag

- Package:200kg/drum

- Sample:Availabe

- Application:Plasticizer

The primary goal of green finance is to enhance the flow of funds from financial institutions to economic entities engaged in environmental protection projects and activities,

In July 2019, the UK government announced a Green Finance Strategy, with plans to build regulatory frameworks for green finance alongside improved access to investment for green

Assessing the impact of green finance on financial

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl phthalate

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:99.5%, 99.5%

- Type:PVC stabilizers

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:25kg/bag

- Package:200kg/drum

- Sample:Availabe

This symbiotic cycle promotes growth. The image highlights the importance of green finance in supporting the Green Technology Finance Program (GTFP) in Chinese eco

Green finance initiatives aim to achieve the 2030 Sustainable Development Goals (SDGs), shifting the focus from creating value for shareholders (economic) to creating value

Can green finance supports improve environmental firm

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:liquid dbp

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:99%

- Type:Chemical auxiliary agent, Plasticizer

- Usage: Leather Auxiliary Agents, Paper Chemicals,

- MOQ:25kg/bag

- Package:200kg/drum

- Quality control:COA ,SDS,TDS

It champions environmental sustainability and corporate social responsibility by funneling investments into eco-friendly enterprises. This helps firms innovate green technologies and

Green financing and green finance refer to alternatives to traditional forms of money. Sustainable finance is a method of using life insurance policies, annuities, IRA accounts, 401(k) plans, and even mutual funds in such a way

- Can Green Finance improve the financial performance of eco-friendly enterprises?

- Therefore, the underlying rationale for this study is to fill the existing knowledge gap by providing empirical evidence on the effectiveness of green finance as a catalyst for enhancing the financial performance of eco-friendly enterprises, thereby supporting the broader goals of sustainable development.

- How does Green Finance Support Company's development?

- Green finance supports company's development by funding environmental projects (Ouyang et al., 2023). For instance, companies can issue green bonds or obtain green loans to fund product and service upgrades and environmental projects, improving firm performance (Ning et al., 2023).

- Should financial institutions promote green finance and fund EP firms?

- (2) Financial institutions should promote green finance and fund EP firms. Banks can create and improve green credit departments to develop customized financing plans for EP firms as well as streamline the approval process and improve green project loan approval.

- Is green finance a catalyst for eco-friendly enterprises?

- This correlation is not merely statistical but signifies a deeper, causal relationship whereby green finance acts as a crucial catalyst, fostering the economic acumen of eco-friendly enterprises through efficient capital allocation and the facilitation of vital information exchange.

- Does green finance support affect environmental protection firms' economic and social performance?

- An inverse relationship exists between green finance support and economic performance. Green finance support reduces barriers to financing and fostering innovation. This study analyzes how green finance supports affect environmental protection firms’ economic and social performance.

- What is green finance?

- In explicit terms, green finance facilitates financial services for projects in areas such as environmental protection, energy conservation, clean energy, green transportation, and green construction, encompassing project financing, project operations, and risk management.