Days Payable Outstanding (DPO): Definition and How It's

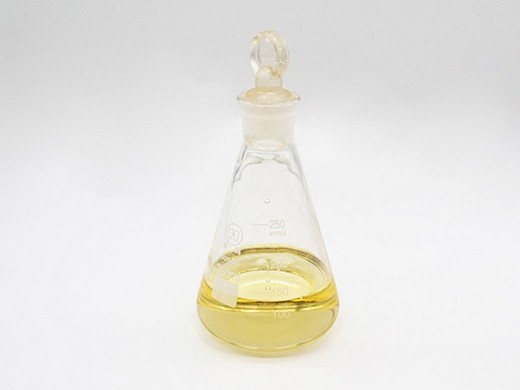

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP, diocty phthalate, 1,2-phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5

- Type:Carbon Black

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Place of Origin::China

- Item:T/T,L/C

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is

Understanding the significance of DPO in financial management. Days Payable Outstanding is an important financial management metric for monitoring cash flow and vendor

Days Payable Outstanding Meaning, Calculation, Benefits

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dioctyl Phthalate DOP

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5, ≥99.5

- Type:Chemical additives, Chemical dop plasticizer 99%

- Usage:Coating Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Payment:T/T

- Application:PVC Plasticizer

However, they measure different aspects of a business' financial performance: DSO measures the average number of days it takes for a business to collect payment after a sale

The finance function can be regarded as the spider in the organizational web, as it has relations with every part of the organization and is also represented on the executive board. Therefore,

7 essential finance features for your digital operation

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP Bis(2-ethylhexyl) phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.99, 99%

- Type:Plastic Auxiliary Agents

- Usage:Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Place of Origin::China

- Advantage:Stable

financial performance, trends, and forecasts, supporting strategic decision-making and regulatory compliance. The author admits that his affinity to the number 7 is part of the reason for the

Table of Content: 1. Introduction2. Importance of a high-performing strategic finance team3. Key skills needed for success in a strategic finance team4. Roles within a

Business performance analytics with Dynamics 365 Finance

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:Liquid DOP, DOP oil

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99

- Type:Adsorbent, Carbon Black

- Usage:Coating Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Application:PVC Plasticizer

In the evolving landscape of business, the need for integrated, real-time analytics is paramount. Companies are challenged by data that's dispersed across multiple systems,

Empower financial teams with real-time visibility. Enable the organization to scale in step with current business demands. Key findings. Dynamics 365 Finance enables

Follow The Money: DOP Planning and Analytics Redefines

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP/Dioctyl Phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%, 99.5%

- Type:Carbon Black

- Usage:Plasticizer

- MOQ:200kgs

- Package:200kgs/battle

- Payment:T/T

Although some people mistakenly think of planning or performance management as geared primarily towards the office of finance, according to recent Forrester Research, there are

: Sify Technologies Limited (NASDAQ: SIFY), a leader in Managed Enterprise, Network, IT and Applications services in India with global delivery capabilities, has won the award for the “Best Use of Technology for Social Cause” for its Department of Post (DoP) Network Integration Project, at the Dataquest Business Technology Awards. As part of the Rs.

- What is a good DPO for a business?

- Lenders and investors can use the DPO to understand and evaluate a business’ creditworthiness. A low DPO can be an indicator that the business has a good financial position. Whereas a high DPO can easily become a red flag for lenders and investors as it indicates that the business is struggling with cash flow problems.

- How can DPO improve cash flow and improve financial performance?

- Several companies have successfully implemented DPO strategies to optimize cash flow and improve financial performance. For example, Procter & Gamble was able to improve its DPO from 50 days to 75 days by renegotiating payment terms with suppliers and implementing a more efficient payment processing system.

- How does a business' credit rating affect its DPO?

- If a business has a strong credit rating, it might be able to negotiate longer payment terms with the supplier, which would increase its DPO. However, if a business has a poor credit rating, then the business will have to pay the bills faster, decreasing its DPO. 3. Cash Flow A business’ cash flow has a strong influence on its DPO.

- Why is a high DPO important?

- A high DPO is often desirable because if a company takes longer to pay creditors, it has more cash available in the short term to use for other purposes. While DPO is an important measure of cash outflows, days sales outstanding (DSO) is the corresponding metric for cash inflows.

- What makes a good business performance planning solution?

- To support an efficient and accurate planning process, a solution must provide streamlined aggregation of data, a familiar and collaborative set of tools, and the ability to transform a plan into action. Business performance planning offers financial and operational planning and analytics that create a connected enterprise experience.

- Is a high DPO a good investment?

- DPO is a key financial metric for tracking and managing cash flow. A high DPO is generally favorable because it means more cash is available to fund operations. However, reducing DPO may be advantageous if it means the company qualifies for vendor discounts or other incentives.