Scaling Up Business Financing and Nigeria’s Industrial

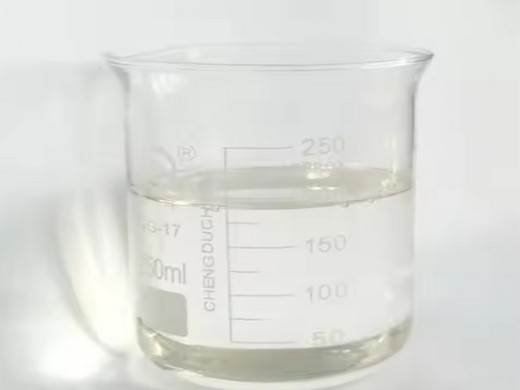

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DiOctyle Phthalate DOP

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99%min

- Type:Plastic Auxiliary Agents

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Storage:Dry Place

business environment will attract additional private capital to drive development and improve Nigeria’s competitiveness Growing Business Financing in Nigeria Collateral Registry Financial

Key concepts in business finance. Time value of money: This concept recognizes that money has a time value, and its future worth is influenced by interest rates and inflation.;

Holding It All in Tension: The Risks and Opportunities of

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DiOctyle Phthalate DOP

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:≥99.5%

- Type:Plasticizer, Dioctyl Phthalate

- Usage:Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Payment:T/T

- Application:PVC Plasticizer

Introduction to Nigeria. Nigeria, Africa’s most populous country, contains more than 250 ethnic groups who speak more than 500 indigenous languages. 3 The country’s

Financing of business operations is a critical requirement for the success of any business venture and thus is fundamental to the achievement of the corporate objectives of

Doing business in Nigeria DLA Piper Africa

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP/Dioctyl Phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99

- Type:pvc additive

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Payment:T/T

In the 2020 Ease of Doing Business index developed by the World Bank, Nigeria’s rank jumps from 146 to 131, globally, moving up 15 places and 21st in the Sub-Saharan

Combining oil and gas wealth with the entrepreneurial efforts of its predominantly young population, Nigeria has developed a business-friendly environment over the past two decades

SUSTAINABLE FINANCE IN NIGERIA: PERFORMANCE

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP/Dioctyl Phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%, 99.5%

- Type:non-toxic calcium zinc stabilizer

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Paper Chemicals

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

Sustainable Finance in Nigeria: Performance and Outlook Thursday, 27 October 2022| 17 SUSTAINABLE FINANCE PERFORMANCE IN NIGERIA In 2015, Nigeria signed up to the

assess the effects of capital structure on the financial performance of listed non-financial firms in Nigeria. The other specific objectives are to assess the effect of short-term debt, long-term

Investment in Nigeria KPMG

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP Bis(2-ethylhexyl) phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.9%

- Type:Plasticizer

- Usage:Coating Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Model:Dop Oil For Pvc

Nigeria became independent in 1960, having been under British colonial rule since 1861. The country is situated on the West Coast of Africa, some 649 km north The Nigerian Financial

The World Bank today approved the Nigeria State Action on Business Enabling Reforms (SABER) Program-for-Results. The $750 million International Development

- What are the key aspects of Business Finance in Nigeria?

- Business finance is essential for the success and growth of businesses in Nigeria. Access to capital, cash flow management, and financial planning are vital to ensure sustainable operations and to seize growth opportunities. This blog post aims to shed light on the key aspects of business finance in Nigeria.

- How did business improve in Nigeria?

- Nigeria improved significantly in “starting a business, dealing with construction permits, getting electricity, registering property, trading across borders and enforcing contracts” indices. Download our guide to doing business in Nigeria, which covers: This article forms part of Doing Business in Africa:

- What financing options are available for businesses in Nigeria?

- In the Nigerian business landscape, businesses can tap into diverse financing avenues: debt, equity, government aid, and alternative sources. Debt financing, a favorite choice, involves securing funds from banks for expansion or operations. Bonds and debentures are additional debt options.

- How does KPMG help a business start-up in Nigeria?

- KPMG’s approach helps you cut through the complexity of market entry and business start-up in Nigeria, by taking on your burden of start-up compliance and back-office activities so that you can focus on your core business. Labour matters are overseen by the Ministry of Labour and Employment.

- How much infrastructure financing is needed in Nigeria?

- Infrastructure financing needs are estimated at $130billion to $170billion a year. The Sustainable Banking Network (SBN) Progression Matrix report indicated that Nigeria had put comprehensive implementation actions in place and begun to report on results and impacts of sustainable finance.

- Who is the leading bank for capital investment in Nigeria?

- Citibank Nigeria Limited emerged the leading bank for capital investment in Nigeria in Q4 2020 with US$216.17m (about 20.21% of the total capital inflow in Q4 2020). Since independence in 1960, Nigeria’s infrastructural facilities have suffered neglect from successive governments.