DBP, partners champion Green Financing News Eco-Business

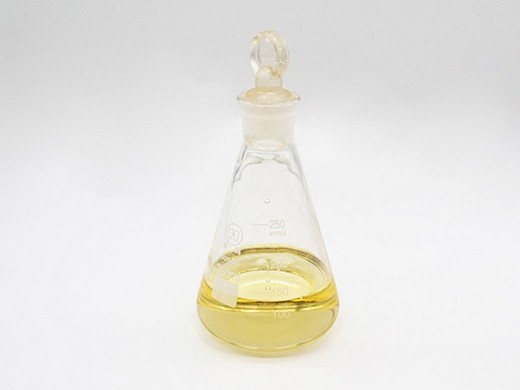

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl Phthalate (DBP)

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:98%

- Type:Plastics Additives

- Usage: Plastic Auxiliary Agents, Textile Auxiliary Agents,

- MOQ:200kgs

- Package:200kgs/battle

- Quality control:COA ,SDS,TDS

The Development Bank of the Philippines (DBP) has partnered with four institutions to promote Green Financing investing in processes and systems friendly to the

Image from Power Philippines The Development Bank of the Philippines (DBP) has emerged as a key player in promoting sustainable development through its innovative

Environment and Climate Change Development

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:DBP

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:99.8

- Type:Adsorbent

- Usage: dibutyl phthalate(dbp) Rubber Auxiliary Agents,

- MOQ:25kg/bag

- Package:200kg/drum

- Quality control:COA ,SDS,TDS

4 days agoProving its commitment to environmental protection and sustainable development, DBP is one of the first Philippine banks to integrate environmental considerations in all aspects of its operations. It provides financing as well as

Local banks like the Bank of the Philippine Islands (BPI), the Development Bank of the Philippines (DBP), and LANDBANK are a few financial institutions that offer loans for green projects. To learn more about the loans

DENR, DBP, other partners ink agreement for green financing

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:liquid dbp

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:99%min

- Type:Chemical auxiliary agent, Plasticizer

- Usage: Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Sample:Availabe

To help local government units and regulated industries, the Department of Environment and Natural Resources (DENR) through the Environmental Management Bureau

DBP operates more than 127 branches, it was founded in 1947 and is headquartered in Makati City, the Philippines. DBP has developed the Development Bank of the Philippines

DBP gets GCF accredited for climate-related financing

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl phthalate DBP

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:99%min

- Type:PVC additives

- Usage:dibutyl phthalate(dbp)

- MOQ:25kg/bag

- Package:200kg/drum

- Quality control:COA ,SDS,TDS

Catalog; For You; The Manila Times. DBP gets GCF accredited for climate-related financing 2021-07-26 . STATE-OWNED Development Bank of the Philippines (DBP) has

The Green Finance Framework for this bond has been reviewed and approved by Sustainalytics, ensuring the projects funded are genuinely green and sustainable. Vesteda’s €500 Million

Green finance and high-quality development of marine

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Bis(2-ethylhexyl) phthalate, Ethyl..

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:99%, 99%

- Type:Plasticizer, Plasticizer DBP Dibutyl Phthalate

- Usage:Coating Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Delivery:Within 7-15 Days

Design/methodology/approach. In this paper, the entropy method is used to measure the development level of green finance, the DEA-ML index is used to measure the green total factor productivity which is used to indicate the high-quality development level of the marine economy in 11 coastal provinces (cities), then the grey correlation degree between them whose result

DBP is partnering with the ECCP in its program of greening industries such as the SMEs for environmental Accountability, Responsibility and Transparency (SMART) Cebu project aimed at increasing

- What is DBP Sustainable Financing Framework?

- DBP has developed the Development Bank of the Philippines Sustainable Financing Framework (the “Framework”) under which it intends to issue social, green and sustainability bonds and use the proceeds to finance and refinance, in whole or in part, existing and/or future assets with positive environmental and social outcomes in the Philippines.

- What does DBP do?

- 1. USE OF PROCEEDS DBP will finance or refinance green and social sustainability projects and activities that are related to the Bank’s various sustainability programs.

- How does DBP manage its funds?

- Within its framework, DBP will track the use of proceeds through its internal reporting systems. Pending full allocation, the unallocated proceeds will be invested in high quality money market instruments in accordance with DBP’s liquidity management strategy.

- Should DBP issue SustainAbility Bonds?

- Based on DBP’s responsible financing activities, Sustainalytics considers that DBP is well positioned to issue sustainability bonds and that they will support the bank in advancing its sustainability preparedness and performance.

- What does DBP stand for?

- Client Relations [email protected] (+85) 2 3008 2391 The Development Bank of the Philippines (“DBP” or “the bank”) is a governmental financial institution that provides development and corporate banking, corporate financing, trade products and services in addition to revolving credit lines or treasury products.

- How many branches does DBP have?

- DBP operates more than 127 branches, it was founded in 1947 and is headquartered in Makati City, the Philippines.