React App

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

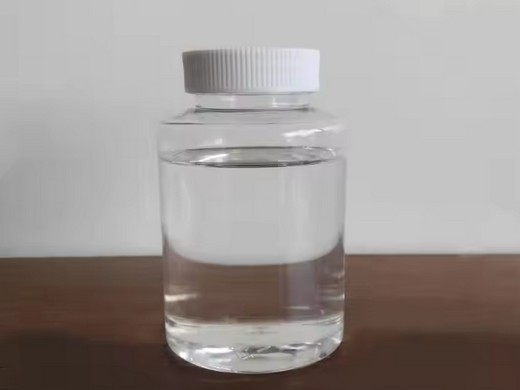

- cas no 117-84-0

- Other Names:DOP, diocty phthalate, 1,2-phthalate

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99.5%, 99.5%

- Type:Adsorbent, plasticizer

- Usage:Coating Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Advantage:Stable

- Keywords:Plasticizer Dop

We are Dealers, Distributors & Importers of PVC Resin, Plasticisizers & Additives. is a leading provider of high- quality chemicals and polymers such as PVC Resin, PVC Paste Resin, DOP, DBP, CPW, DINP, DOTP, DOA, TOTM,

We Deliver On Quality, Cost and Sustainability Importer of Wild and Farmed Shrimp from Ecuador . Oceanfoods is a seafood importer that specializes in Wild and Farmed shrimp from Ecuador. emphasis is placed on producing high

IPD Import from Ecuador

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Dop

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99%

- Type:DOP

- Usage:Plastic Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Volume Resistivity:216

- Item:T/T,L/C

The many small and medium-sized enterprises in particular offer persuasively high-quality timber products sourced from legal and sustainable forestry. The same applies for all products: IPD connects European importers with tried-and

A time-saving and effective solution can be accessed through one of BestFoodImporters databases, by gaining access to many active food importers from Ecuador.

Ecuamar Ecuadorian Shrimp for Export

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:Chemical Auxiliary Agent

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99%min

- Type:Adsorbent

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Item:T/T,L/C

Born in the south of Ecuador, Yuri Caicedo was raised in a shrimp industry environment., his parents and relatives own shrimp farms in the provinces of El ORO and Guayas famous for its

In addition to duties, all imports are subject to a 12 percent value-added tax and an additional 0.5 percent tax for the Children’s Development Fund applied to the CIF value of the

Dop Importers and Buyers List in Ecuador Ecuador

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP, Dioctyl phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:≥99.5%

- Type:Liquid, plasticizer

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents, Plasticizer

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Shape:Powder

- Model:Dop Oil For Pvc

Check new buyers of dop in Ecuador. Our data covers dop importers list in Ecuador, import quantity of dop, value, buyers name of dop, import partners and other shipment details. Look

ECUALIMFOOD grows, processes and exports high quality frozen (IQF) fruits and vegetables thinking in the future and sustainability of fresh and healthy food. Being in Ecuador, the middle

Plasticizer Dop Buyers & Importers in Malaysia

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP, diocty phthalate, 1,2-phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:≥99.5%

- Type:Oil drilling

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents, Plasticizer

- MOQ:200kgs

- Package:200kgs/battle

- Payment:T/T

- Certificate::COA

TradeFord is a growing Manufacturer Directory and B2B Marketplace connecting Global Plasticizer Dop Importers, Exporters, Suppliers, Traders and Manufacturers at a reliable, common platform. KHQ Industrial Supplies is one of a major supplier and distributor of all high quality rubber products, foams, sponges, engineering plastics

Its clear that it’s made from high-quality materials. I bet that it will last for years. id reccomend it. Flags Importer. 2080 S. Cucamonga Ave. Ontario, CA 91761 USA. Toll free: 1-800-709-3488. Tel: 909-605-2968. (DOP $) Ecuador (USD $) Egypt (EGP ج.م)

- Does Ecuador have a price band system?

- Ecuador maintains the Andean Price Band System on 189 agricultural products, roughly 2.5 percent of its entire tariff schedule, as per the WTO’s Trade Policy Review Body of January 2019. Ecuador applies a special consumption tax (ICE) to certain “luxury” products including distilled spirits, beer, cigarettes, parfums and soft drinks.

- How much tax does Ecuador impose on digital services?

- In addition to duties, all imports are subject to a 12 percent value-added tax and an additional 0.5 percent tax for the Children’s Development Fund applied to the CIF value of the merchandise. Since September 2020, Ecuador imposes a 12 percent VAT rate on imported digital services, when the consumer is an Ecuadorian resident.

- Does Ecuador have a special consumption tax?

- Ecuador applies a special consumption tax (ICE) to certain “luxury” products including distilled spirits, beer, cigarettes, parfums and soft drinks. The ICE rates as of January 2023 are summarized in the following table: Table 1: 2023 ICE rates Excise tax: $ 0.18 per 100 grams of added sugar.