hot sale Dop HS Code for Export

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:Dioctyl Phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5%, 99% min

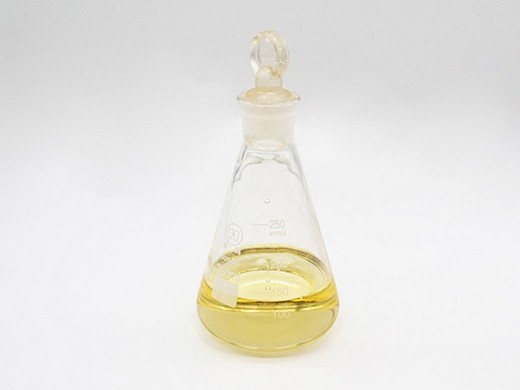

- Type:Plasticizer Colorless Oily Liquid DOP for pvc and rubber

- Usage:Coating Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Application:PVC Plasticizer

hot sale Dop HS Code for Export. Import Data and Price of dop dioctyl phthalate under HS Code. Classification: Chemical Auxiliary Agent; CAS No.: 117-81-7; Other Names: Dioctyl Phthalate; MF: C6H4(COOC8H17)2; EINECS No.: 204-211-0; Purity: 99.6%, 99.6%; Type:

Find accurate Phthalate dop HSN Code from 21 options. HS Code 29173920 is most popular, used in 7.2M+ export import shipments.

29173920 Other: Dioctyl phthalate ITC HS CODE List.

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP, Dioctyl phthalate

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5% Min

- Type:pvc additive

- Usage:Plastic Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Place of Origin::China

29173920 Other: Dioctyl phthalate Search List of Indian ITC HS Code and HS classification System Code, Harmonised System product code, Exim Codes Lookup and HS

As per Volza’s Global Export data, Phthalate dop export shipments stood from World at 12.4K, exported by 648 World Exporters to 1,323 Buyers.; World exports most of it's

Dop Dioctyl Phthalate Imports Under Sub Chapter 2917

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:Liquid DOP, DOP oil

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5% Min

- Type:non-toxic calcium zinc stabilizer

- Usage:Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Model:Dop Oil For Pvc

21 rowsImport Export Data; HS Code Search; Bilateral Trade Report; Login; Dop Dioctyl

Use our free HS & HTS code lookup tool to find the tariff code for your products. Simply search using your product’s name, description, or code. If you need further assistance, our customs

How to find the right HS or HTS code Kuehne+Nagel

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DiOctyle Phthalate DOP

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99

- Type:Plasticizer Colorless Oily Liquid DOP for pvc and rubber

- Usage:Plastic Auxiliary Agents, Plasticizer

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Application:PVC Plasticizer

For commodities to successfully cross international borders, the correct HS code (also known as an HTS code) must be declared. This code determines the appropriate duty and tax rate

Use Online HS Code Lookup Tools: Are HS codes used for both imports and exports? A: Yes, HS codes are used universally for classifying goods in international trade,

Global Trade Content, HS Codes, and Rulings Descartes

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP, Dioctyl phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5

- Type:Plasticizer Colorless Oily Liquid DOP for pvc and rubber

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Paper Chemicals, Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Surfactants, Textile Auxiliary Agents, Water Treatment Chemicals

- MOQ:200kgs

- Package:200kgs/battle

- Keywords:Plasticizer Dop

Descartes CustomsInfo is a leading provider of import and export classification, duty, and tax content for international commerce, helping businesses across industries to classify more

The HTS uses the nomenclature structure of the Harmonized System (HS), administered by the World Customs Organization (WCO). It is used across the globe, making

- Can I use HTS codes for exports?

- If you’re doing both importing and exporting, you are required to use HTS codes for your imports, so you might as well continue to use those codes for your exports as well. Note: There are some exceptions to this rule; the Census Bureau publishes a list of HTS codes you can’t use for exports.

- Where can I find the HS code for my product?

- You can find the HS code for your product via your country’s government website, or by using DHL Express’ dedicated MyGTS (Global Trade Services) tool. The structure of each Harmonized System comprises of six digits. The first two digits identify the chapter of which the HS code falls under.

- What is HS code & how does it work?

- For commodities to successfully cross international borders, the correct HS code (also known as an HTS code) must be declared. This code determines the appropriate duty and tax rate payable on the item. How does it work?

- The HS Code system uses an internationally applied 6-digit number as the basis for local country classification.

- What is HSN code 2917320000?

- HSN Code 2917320000: 2917320000 HSN Code 29173920: 29173920 These facts are updated till 13Nov2023, and are based on Volza's Export Import dataof Phthalate dop, sourced from 70 countries export import shipments with names of buyers, suppliers, top decision maker's contact information like phone, email and LinkedIn profiles.

- Which countries have HSN codes?

- Top Related HSN Code By Shipments By Name Top Related Products By Shipments By Name Import Data by Country By Shipments By Name India (3513) United States (1857) Peru (1429) Vietnam (1088) Indonesia (481) Kenya (475) South Korea (471) Philippines (268) Belgium (256) Spain (237) Uganda (231) United Arab Emirates (203) Pakistan

- What is the difference between HS code and HTS code?

- As noted in our article HS Codes, HTS Codes, and Schedule B Codes: What's the Difference?

- , an HTS code takes the same form as an HS code for the first 6 digits and then has 4 differing last digits. Schedule B and HTS codes are separate entities that are used for exporting and importing respectively.