Inicio AV Plastics Trade SAS

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

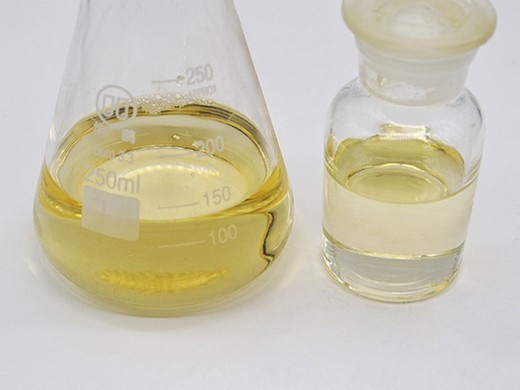

- Other Names:Plasticizer

- Purity:≥99.5%

- Type:Adsorbent

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Model:Dop Oil For Pvc

- Storage:Dry Place

We import a wide variety of specialized series according to your application from various regions of the world. Construction. ranking 308th out of 500 companies reviewed in the Americas

Colombia Imports from Turkey of Rubber Accelerators; Compound Plasticizers for Rubber or Plastics was US$1.63 Thousand during 2023, according to the United Nations COMTRADE

Plasticizer Importers and Buyers List in Colombia Colombia

- Classification:Chemical Auxiliary Agent

- Other Names:Plasticizer

- Purity:99 %

- Type:Adsorbent, Carbon Black

- Usage:Coating Auxiliary Agents

- MOQ:25kg/bag

- Package:200kg/drum

- Shape:Powder

- Model:Dop Oil For Pvc

- Storage:Dry Place

MEXICHEM RESINAS COLOMBIA S.A. S. Importer of Colombia. Various products of the chemical industries prepared vulcanization accelerators; compound plasticizers for rubber or

As per Volza’s Global Import data, Doa plasticizer import shipments in World stood at 608, imported by 148 World Importers from 156 Suppliers.; World imports most of its

Plasticizer Regulations Importer Companies List Turkey

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- Other Names:Plasticizer

- Purity:99.5% min.

- Type:Plastic Auxiliary, Plasticizer For Pvc

- Usage:Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Application:PVC Plasticizer

- Item:T/T,L/C

List of importer companies that want to import Plasticizer Regulations and Plasticizer Regulations Import RFQ form. Enquiry for DOPT Türkiye Turkey Importer. dopt bis (2-ethylhexyl)

Merchandise trade and tariff data for Colombia (COL) Plastic or Rubber import from all countries (trading partner) including Trade Value, Product Share, MFN and Effectively applied tariffs,

Colombia Import Requirements and Documentation

- Classification:Chemical Auxiliary Agent

- Other Names:Plasticizer

- Purity:99.5%, 99.9%min.

- Type:Plastic Auxiliary, Plasticizer For Pvc

- Usage:Chemical Auxiliary Agent, Leather Auxiliary Agents

- MOQ:1000KG

- Package:25kg/drum

- Sample:Availabe

- Application:Plasticizer

Fill out the “Andean Custom Value Declaration” (Declaración Andina de Valor en Aduana) when the import value is equal to or more than USD 5,000 FOB. Fill out the Import

Find Turkish Manufacturers, Suppliers, Exporters, Importers, Buyers, Wholesalers, Products and Trade Leads. Import Export Trade Leads on TurkishExporter.Net

Pvc Plasticizer Importer Companies List Turkey

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- Other Names:Plasticizer

- Purity:99.5% min.

- Type:Adsorbent, Carbon Black

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Quality control:COA ,SDS,TDS

- Delivery:Within 7-15 Days

List of importer companies that want to import Pvc Plasticizer and Pvc Plasticizer Import RFQ form. Russia imports PVC modifier Russia Importer. pvc modifier pvc Enquiry for DOPT

As per Volza’s India Import data, Dinp plasticizer and HSN Code 29173400 import shipments in India stood at 146, imported by 13 India Importers from 18 Suppliers.; India imports most of its Dinp plasticizer and HSN Code 29173400 from Taiwan, South Korea and Malaysia and is the largest importer of Dinp plasticizer and HSN Code 29173400 in the World.; The top 3

- How to import goods from Colombia?

- The following are the main steps to be followed: Make arrangements with a financial entity to pay for the imported goods. Ask the exporter to ship goods to a Colombian port. Obtain approval from Ministry of Commerce, Industry and Tourism for the Import Registration Form or Import License (in the few cases when this is required).

- What information do importers need to submit to the Dian (customs)?

- The importer must submit an import declaration to the DIAN (Customs). This declaration includes the same information contained on the import registration form and other information such as the duty and sales tax paid, and the bank where these payments were made.

- How to get goods out of customs?

- Go to an authorized financial entity and pay the import duties, VAT, surcharges, and other fees. Make arrangements with a Customs Agency to receive the merchandise and get it out of customs. The following are the main steps to be followed: Make arrangements with a financial entity to pay for the imported goods.

- When do I need an import declaration in Colombia?

- This declaration may be presented up to 15 days prior to the arrival of the merchandise to Colombia or up to two months after the shipment’s arrival. Once the import declaration is presented and import duties are paid, customs will authorize the delivery of the merchandise.