EXPLAINER: What’s behind the revived Landbank

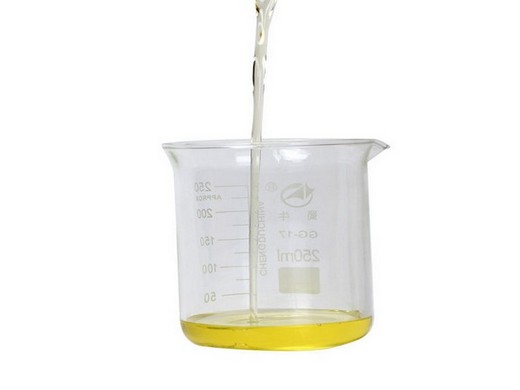

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:DBP

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:99.6%

- Type:Adsorbent

- Usage:Leather Auxiliary Agents, Water Treatment Chemicals

- MOQ:200kgs

- Package:200kgs/battle

- Application:Plasticizer

The merged state bank would end up with 627 branches nationwide, with an ambitious plan to set up at least one Landbank touchpoint either a branch, ATM, agent banking partner, cash deposit

The biggest bank is usually owned by the State,” Secretary Diokno said. To date, the LBP has a total of 752 branches, while the DBP has 147 branches. The combined

Behind ‘regulatory relief’: Landbank, DBP’s challenge

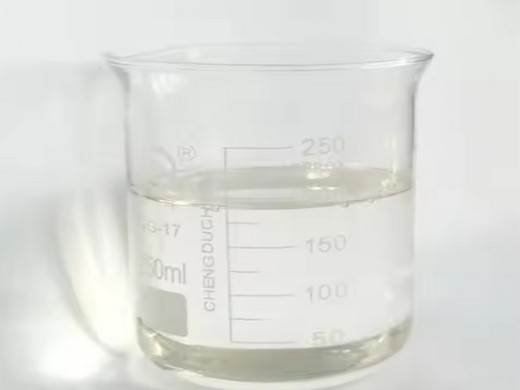

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Bis(2-ethylhexyl) phthalate, Ethyl..

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:99.5%, 99.5%

- Type:Plasticizer, Plasticizer DBP Dibutyl Phthalate

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Paper Chemicals, Surfactants, Textile Auxiliary Agents, Water Treatment Chemicals

- MOQ:200kgs

- Package:200kgs/battle

- Delivery:Within 7-15 Days

The challenge comes after Landbank and DBP had P50 billion and P25 billion respectively of their capital taken away from them to fund the Maharlika Investment Corporation.

But no decisions have been made so far,” the finance chief said. “[We] will have to do further consultations.” Recto said that the public listing of Landbank and DBP would also

BSP chief: Decision on Landbank-DBP merger must be

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl phthalate DBP

- MF:C16H2204

- EINECS No.:201-557-4

- Purity:≥99.5

- Type:PVC additives

- Usage: Surfactants, Textile Auxiliary Agents,

- MOQ:200kgs

- Package:200kgs/battle

- Sample:Availabe

- Application:Plasticizer

- Quality control:COA ,SDS,TDS

- Delivery:Within 7-15 Days

MANILA The planned merger of government-owned Land Bank of the Philippines (Landbank) and Development Bank of the Philippines (DBP) will push through, Bangko Sentral

Local bank stocks have been doing very well and multiples are expanding, but our last “forced by law to IPO” bank offering was Bank of Commerce [BNCOM 6.30, up 0.6%],

Fitch: Merger with DBP to increase LandBank's strategic

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl Phthalate (DBP)

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:99.6%

- Type:Plastics Additives

- Usage:Coating Auxiliary Agents, Electronics Chemicals,

- MOQ:25kg/bag

- Package:200kg/drum

- Sample:Availabe

But Fitch Ratings noted that the combined asset size of LandBank and DBP — or about P4.2 trillion — would just be slightly larger than that of BDO. ‘Too big to fail’ Some

Finance Secretary Benjamin Diokno announced recently the planned merger of the state-owned Land Bank of the Philippines (LBP) and the Development Bank of the Philippines

DBP seeks capital buildup of up to P300 billion Philstar

- Classification:Chemical Auxiliary Agent

- CAS No.:84-74-2

- Other Names:Dibutyl phthalate

- MF:C16H22O4

- EINECS No.:201-557-4

- Purity:≥99.5

- Type:PVC stabilizers

- Usage: Electronics Chemicals, Plastic Auxiliary Agents

- MOQ:25kg/bag

- Package:200kg/drum

- Quality control:COA ,SDS,TDS

State-run Development Bank of the Philippines is hoping to raise its authorized capital stock to P300 billion as the bank seeks to amend its nearly three-decade-old charter.

Development Bank of the Philippines (DBP) of the Philippines: review, and exchange rates 2023. The Development Bank of the Philippines (DBP) is a state-owned financial institution in the Philippines. With a rich history spanning over

- Will Landbank & DBP merge?

- Recto said that the public listing of Landbank and DBP would also play a role in developing the local capital market. The DOF chief confirmed on Tuesday that the proposed merger of Land Bank and DBP is no longer being considered. “Their mandates are totally different, so I think we’re better off with two of them,” the finance chief told reporters.

- Who owns LBP and DBP?

- The biggest bank is usually owned by the State,” Secretary Diokno said. To date, the LBP has a total of 752 branches, while the DBP has 147 branches. The combined branches of both banks will result in a wider network for banking operations. However, only 22 branches of the DBP will be retained as a result of the merger.

- What is the difference between LBP and DBP?

- That’s really the best practice. The biggest bank is usually owned by the State,” Secretary Diokno said. To date, the LBP has a total of 752 branches, while the DBP has 147 branches. The combined branches of both banks will result in a wider network for banking operations.

- What is the difference between Landbank and DBP?

- Though each bank has its own separate charter – with Landbank envisioned to cater mostly to the agricultural sector and the DBP to industries – the DOF said that they share the mandate of providing “banking services for agricultural and industrial enterprise and to spur countryside development.”

- Should state support Landbank vs DBP?

- “All else equal, this suggests that the state’s propensity to support the bank should become higher,” Febrian added. LandBank caters to the needs of the agriculture sector, while the DBP hands out development loans for the sector in its capacity as a development bank.

- What does DBP stand for?

- The government has proposed a merger between the Landbank of the Philippines (LBP) and the Development Bank of the Philippines (DBP) to create a bigger, stronger, and more resilient bank that can better serve the country’s development needs.