USDA bans school lunch fees for low-income families MSN

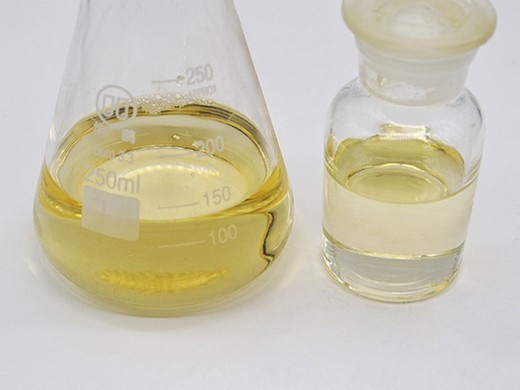

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:123-79-5

- Other Names:Dioctyl adipate/DOA

- MF:C22H42O4

- EINECS No.:Dioctyl Adipate (DOA)

- Purity:99.90%

- Type:Dioctyl Terephthalate

- Usage:Chemical auxiliary agent, Plasticizer

- Package:200kgs/battle

- Storage:yes

The new Agriculture Department's policy becomes effective starting in the 2027-2028 school year. With this rule, the USDA will lower costs for families with income under 185% of federal

: 742 KB: November 26, 2024: 772 KB: November 25,

Grants and Loans USDA

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:103-23-1

- Other Names:Dioctyl Adipate DOA

- MF:C22H4204

- EINECS number:203-090-1

- Purity:99.90%

- Type:Adsorbent

- Usage:Electronics Chemicals, Leather Auxiliary Agents, Paper Chemicals, Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Surfactants, Textile Auxiliary Agents

- Package:25kg/drum

- Appearance:Colorless liquid

- Assay:99%

- Storage:yes

This matching grant program, also known as FSMIP, provides matching funds to State Departments of Agriculture and other appropriate State agencies to assist in exploring new

What governs this program? 7 CFR, Part 3555 This part sets forth policies for the Single-Family Housing Guaranteed Loan Program (SFHGLP) administered by USDA Rural Development. It addresses the requirements of section 502(h) of

Single Family Housing Direct Home Loans Rural

- Classification:Chemical Auxiliary Agent

- CAS No.:103-23-1

- Other Names:Cold resistant Plasticizer DOA

- MF:C22H4204

- EINECS number:203-090-1

- Purity:99.5

- Type:Dioctyl Terephthalate

- Usage:Coating Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- Package:25kg/drum

- Sample:yes

, the current interest rate for Single Family Housing Direct home loans is 4.375% for low-income and very low-income borrowers. Fixed interest rate based on current market rates at loan approval or loan

USDA is a government agency that provides services and assistance related to food, agriculture, and natural resources.

USDA Loans: A Complete Guide to Rural

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- CAS No.:123-79-5

- Other Names:Dioctyl Adipate

- MF:C22H42O4

- EINECS No.:203-090-1

- Purity:99.5

- Type:Dioctyl Terephthalate

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- Package:25kg/drum

- Appearance:Colorless liquid

- Assay:99%

If you’re eligible for payment assistance, your rate may be as low as 1%. Repair loans also have a fixed 1% rate. USDA Direct Loans, on the other hand, have a fixed-rate of 2.50% for low-income and very low-income

With subsidies, interest rates can be as low as 1%. These loans also offer terms of up to 38 years. The USDA usually issues direct loans for homes with a market value below the area loan limit.

USDA bans school lunch fees for low-income

- Classification:Chemical Auxiliary Agent

- CAS No.:103-23-1

- Other Names:DOA

- MF:C22H4204

- EINECS number:203-090-1

- Purity:99

- Type:Chemical Auxiliary Agent

- Usage:Electronics Chemicals, Paper Chemicals, Plastic Auxiliary Agents

- Package:200kgs/battle

- Sample:yes

3 days agoThe new Agriculture Department’s policy becomes effective starting in the 2027-2028 school year. The U.S. Department of Agriculture announced students eligible for free or reduced price school

Our vision: The Oregon Department of Agriculture remains able to serve the changing needs of Oregon’s diverse agricultural and food sectors to maintain and enhance a healthy natural resource base and strong economy in rural and urban communities across the state.

- What is a USDA loan?

- Learn more about USDA loans, which are given out by the United States Department of Agriculture (USDA) to help low- or moderate-income people buy, repair or renovate homes in rural areas. With the help of a USDA loan, owning a home in a rural part of the country might be more accessible than you think.

- What is the interest rate on a USDA guaranteed loan?

- Interest rates for USDA Guaranteed Loans are set by the lender and can vary based on a number of factors like your income, credit and likelihood to repay the loan. If you’re eligible for payment assistance, your rate may be as low as 1%. Repair loans also have a fixed 1% rate.

- Why do USDA home loans have lower rates than conventional mortgages?

- In addition to having no down payment requirements, USDA home loans often also have lower rates than conventional mortgages because the government is taking on the risks associated with lending. This is true even when the USDA issues the loans.

- Do USDA Loans require a down payment?

- USDA loans don’t require you to pay a down payment in addition to closing costs, so you save a little bit of money upfront. With USDA loans, you also don’t have to pay private mortgage insurance (PMI) like you would with a conventional loan.

- What is a USDA Rural Development Loan?

- USDA loans are an attractive mortgage option for low- to medium-income homebuyers who live in rural areas and may not qualify for a conventional, FHA or VA loan. Consider a USDA rural development loan if you’re interested in buying, refinancing or renovating a home in a rural community that will be your primary residence.

- How much are closing costs on a USDA mortgage?

- When purchasing, you have the added benefit of seller concessions to cover up to 6% of your closing costs and you can choose to roll your closing costs into your mortgage balance. The total closing costs for USDA mortgages are typically equal to 3-6% of the purchase price.