A guide for company directors in Saudi Arabia Linklaters

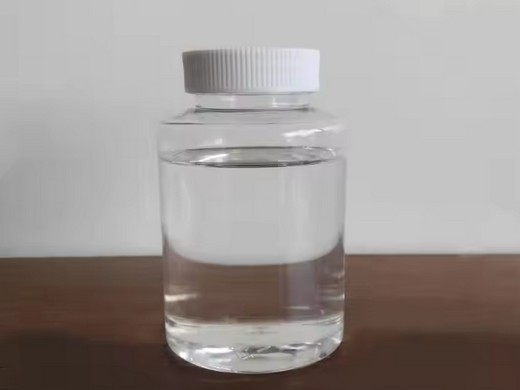

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Chemical Auxiliary Agent

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5

- Type:Liquid, plasticizer

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Payment:T/T

Directors usually have wide powers to manage the affairs of their company and act as its agent and a duty to do so with due care, skill and diligence. This guide aims to help

On 2 May 2016, the new Companies Regulations were introduced in the Kingdom of Saudi Arabia to replace the previous regulations that were implemented in Saudi Arabia over 50 years ago.

InfoPAKSM Corporate Governance and Directors' Duties

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DiOctyle Phthalate DOP

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.99, 99%

- Type:Carbon Black

- Usage:PVC Products, Coating Auxiliary Agents, Leather Auxiliary Agents,

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Model:Dop Oil For Pvc

Corporate governance in Saudi Arabia is principally focused on listed companies although it is increasingly becoming a key issue for the large number of family-owned companies in Saudi

(7) C H Johnson, R E Pump, "Kingdom of Saudi Arabia" in D Campbell, C Campbell, Legal Aspects of Doing Business in the Middle East, 2nd ed (Juris, Release 4,

The New Saudi Companies Law: What You Need to Know

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP/Dioctyl Phthalate

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99%

- Type:Chemical additives, Chemical dop plasticizer 99%

- Usage:PVC Products, Coating Auxiliary Agents, Leather Auxiliary Agents,

- MOQ:200kgs

- Package:200kgs/battle

- Advantage:Stable

- Payment:T/T

The renamed Ministry of Commerce and Investment (“MoCI”) and the Saudi Arabian General Investment Authority (“SAGIA”) are having to get to grips with the significant changes under

each JSC director. The Current Law requires that shares worth SAR10,000 be deposited with a Saudi bank as a guarantee in respect of the liability of each director. The arrangements to

What Is New? The New Saudi C Squire Patton Boggs

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:DOP

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99 %

- Type:Carbon Black

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Item:T/T,L/C

Relatedly, Article 27 expressly prohibits a director or a manager from: • having any direct or indirect interest in activities or contracts undertaken on behalf of the company, except

There have been various developments recently in Saudi Arabia towards increasing the effectiveness of the Corporate Governance framework. The Saudi Capital

Company Types in the Kingdom of Saudi Arabia

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP Bis(2-ethylhexyl) phthalate

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:≥99.5%

- Type:Plasticizer Colorless Oily Liquid DOP for pvc and rubber

- Usage:Coating Auxiliary Agents, Electronics Chemicals, Leather Auxiliary Agents, Paper Chemicals, Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Surfactants, Textile Auxiliary Agents, Water Treatment Chemicals

- MOQ::10 Tons

- Package:25kg/drum

- Volume Resistivity:365

- Item:T/T,L/C

Knowing which corporate vehicle to use is a key concern in any commercial enterprise. This article will summarise the different types of corporate entity used within the Kingdom of Saudi Arabia

A person working as Director in Saudi Arabia typically earns around 27,200 SAR. For the people who work as Director in Saudi Arabia, the average difference between the salary of male and female employees is 9%. Male: 28,700 SAR.

- Do Saudi companies owe fiduciary duties?

- ll CompaniesThe Companies Law adds new provisions addressing key issues arising under any corporate form, as well as new provisions on managers and directors EntitlementsIt has often been debated whether directors of Saudi companies, particularly limited liability companies (LLCs), owe fiduciary duties to the company and

- When does Saudi Arabia's new companies law come into force?

- On 28 June 2022, the Kingdom of Saudi Arabia (“KSA”) approved a new Companies Law via Cabinet Decision No. 678/1443 (the “Companies Law” or the “Law”), which will come into force 180 days from Friday 22 July 2022 (i.e. on 4 January 2023).

- What does the new law mean for Saudi companies?

- The new law abolishes certain corporate forms, namely companies with variable capital and partnerships limited by shares, from the Current Law. We expect this change to have little practical effect given that these forms have only very rarely been used in the Saudi market.

- Will the CG regulations apply to Saudi listed companies?

- The CG Regulations will apply to both Saudi listed companies and on a best practice voluntary basis to closed JSCs (favoured by many Saudi Family owned groups). Once approved the CG Regulations will replace the existing CMA Corporate Governance regulations which apply to Saudi listed companies.

- Should shares be deposited with a Saudi bank?

- Under the Current Law, shares worth SAR10,000 must be deposited with a Saudi bank as a guarantee in respect of each director's liability. Arrangements for implementing this requirement have been problematic, and non-compliance results in the board appointment being void.

- What changes have been made to the OGM process in Saudi Arabia?

- Guarantee shares no longer required from directors. Shares to value of SAR 10,000 must be deposited with Saudi bank as a guarantee of director’s liability. Every shareholder can now attend shareholder meetings. Shareholders with less than 20 shares did not have right to attend shareholder meetings. Minimum notice period for OGMs reduced to 10 days.