Custom Duty Calculator icegate

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

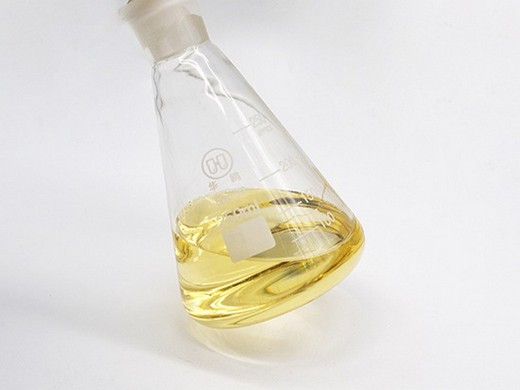

- Other Names:DOP, Dioctyl phthalate

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5% Min

- Type:pvc additive

- Usage:Leather Auxiliary Agents, Paper Chemicals, Petroleum Additives, Plastic Auxiliary Agents, Rubber Auxiliary Agents, Textile Auxiliary Agents, Leather Auxiliary Agent,Plastic Auxiliary Agent,

- MOQ:200kgs

- Package:200kgs/battle

- Shape:Powder

- Model:Dop Oil For Pvc

It provides service to the trade to calculate applicable custom duty on goods imported or exported by them.

Find Customs Import Duty and HS Codes of pvc compound plasticizers in India. Skip to main content. Toggle navigation. Subscribe; USA Import Data . USA Import Data; Manage

Chapter 39: Plastics and articles thereof of India Import Duty,

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:Dioctyl Phthalate DOP

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5% Min

- Type:non-toxic calcium zinc stabilizer

- Usage:Coating Auxiliary Agents, Leather Auxiliary Agents, Paper Chemicals, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Shape:Powder

- Application:PVC Plasticizer

Customs Duty of Articles For The Conveyance Or Packing Of Goods, Of Plastics; Stoppers, Lids, Caps And Other Closures, Of Plastics: 3924: Customs Duty of Tableware,

The Indian Ministry of Finance on 13 June 2024 published an official notification in the Gazette of India pertaining to the implementation of a temporary anti-dumping duty (ADD) on imported

CBIC extends levy of Provisional Anti-Dumping

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DOP

- MF:C24H38O4

- EINECS No.:201-557-4

- Purity:99.5

- Type:Plastic Auxiliary, Dop Plasticizer For Pvc

- Usage:Leather Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ:200kgs

- Package:200kgs/battle

- Application:PVC Plasticizer

Read about Customs Notification No. 09/2024 imposing provisional anti-dumping duty on Poly Vinyl Chloride Paste Resin from specified countries to protect Indian industry. and imported into India, a provisional

Find Customs Import Duty and HS Codes of pvc resin in India. Skip to main content. Toggle navigation. Subscribe; USA Import Data . USA Import Data; Manage Subscription; Buyers

How to Calculate Customs Duty on Imported Goods in India

- Classification:Chemical Auxiliary Agent

- CAS No.:117-84-0

- Other Names:DiOctyle Phthalate DOP

- MF:C6H4(COOC8H17)2

- EINECS No.:201-557-4

- Purity:99 %

- Type:Adsorbent

- Usage:PVC Products, Coating Auxiliary Agents, Leather Auxiliary Agents,

- MOQ:200kgs

- Package:200kgs/battle

- Application:PVC Plasticizer

V. Steps to Calculate Customs Duty in India. Calculating customs duty on imported goods in India involves several steps. Below is a step-by-step guide to help you calculate

The Central Board of Indirect Taxes and Customs (CBIC) has issued a few instructions in relation with the restrictions on the import of products made of plastic.. The Board has issued the instructions on Wednesday in

Dop Plasticizer Import Data of HS Code 29173920 India Seair

- Classification:Chemical Auxiliary Agent, Chemical Auxiliary Agent

- cas no 117-84-0

- Other Names:Liquid DOP, DOP oil

- MF:C24H38O4, C24H38O4

- EINECS No.:201-557-4

- Purity:99.5% min.

- Type:Liquid, plasticizer

- Usage:Coating Auxiliary Agents, Plastic Auxiliary Agents, Rubber Auxiliary Agents

- MOQ::10 Tons

- Package:25kg/drum

- Payment:T/T

Get detailed and the latest Dop Plasticizer import data of HS code 29173920 India with customs shipment details as price, date, Indian import port, importers and buyers in India. data and

Get detailed and the latest Plasticizer Dop import data of HS code 29173920 India with customs shipment details as price, date, Indian import port, importers and buyers in India. Duty; 18

- Does India have a temporary anti-dumping duty on PVC paste?

- The Indian Ministry of Finance on 13 June 2024 published an official notification in the Gazette of India pertaining to the implementation of a temporary anti-dumping duty (ADD) on imported PVC paste from six countries, namely China, South Korea, Malaysia, Thailand, Taiwan, and Norway.

- Can plastic products be imported?

- The Central Board of Indirect Taxes and Customs (CBIC) has issued a few instructions in relation with the restrictions on the import of products made of plastic.

- What is customs duty in India?

- Understanding Customs Duty in India Customs duty is a tax that is imposed on goods that are imported into India from foreign countries. This tax is an important source of revenue for the Indian government and is used to regulate the flow of goods across borders.

- Is 'poly vinyl chloride paste resin' a dumping duty?

- Ministry of Finance, through Notification No. 09/2024-Customs (ADD) dated 13 June 2024, has imposed a provisional anti-dumping duty on ‘Poly Vinyl Chloride Paste Resin’ imported from China PR, Korea RP, Malaysia, Norway, Taiwan, and Thailand.

- What is anti-dumping duty & customs duty?

- The Anti-Dumping Duty is levied as a percentage of the value of the imported goods and is usually imposed on goods that are being imported in large quantities and are causing injury to the domestic industry. Customs duty is an important source of revenue for the Indian government and is used to regulate the flow of goods across borders.

- What is basic customs duty (BCD)?

- Basic Customs Duty (BCD): Basic Customs Duty is the most common type of customs duty in India. It is a duty that is levied as a percentage of the assessable value of the imported goods. The assessable value of the goods is calculated by adding the cost of the goods, insurance charges, and freight charges incurred in transporting the goods to India.